Coinbase

2012

Not available

coinbase.com

2700+

Coinbase – popular licensed cryptocurrency exchange for beginners

What is Coinbase? In this Coinbase review we will try to cover absolutely everything related to Coinbase.

Coinbase is a cryptocurrency exchange founded in 2012.

Coinbase started as a site to send and receive Bitcoin (BTC), but since then has grown into a company with thousands of employees and tens of millions of customers around the world.

Coinbase can currently be considered as one of the most popular cryptocurrency exchange in the world as well as one of the most established cryptocurrency exchange in the United States.

Coinbase offers its users two separate crypto trading platforms – Coinbase and Coinbase Pro.

One of them is aimed mainly at beginners and the other is a more advanced trading platform with more features.

However, your Coinbase Pro login details are exactly the same as you Coinbase login credentials.

Once you have created your Coinbase account, you will have access to both of them using the same Coinbase login details. We’ll talk about the differences of those two a bit more later on.

Coinbase sign up bonus

Coinbase safety and regulation

Coinbase offers its users enough safety and it can be considered a very trustworthy exchange.

Coinbase can actually be considered even more secure than the industry average.

Especially as in the US all cash balances in Coinbase are protected by the Federal Deposit Insurance Corporation (FDIC) for up to $250 000.

Coinbase, Inc. is also regulated and licensed as a money transmitter in the United States.

For example, in New York Coinbase is regulated by the New York State Department of Financial Services. In Ohio by Ohio Division of Financial Institutions and so on.

Is Coinbase safe to use?

In addition to the above, Coinbase keeps 98% of all customer funds in cold storage and the other 2% is covered by Coinbase insurance policy.

So compared to many other exchanges Coinbase can actually be considered VERY safe.

Although other major cryptocurrency exchanges are definitely secure as well.

Coinbase Account security options

Coinbase offers two-factor authentication (2FA) and biometric fingerprint logins on all accounts. And of course, Coinbase digital wallets and private keys use AES-256 encryption.

What’s the difference between Coinbase and Coinbase Pro?

When people are talking about Coinbase, they often refer to two different names – Coinbase and Coinbase Pro. Are Coinbase and Coinbase Pro the same things or if they aren't, what's the difference between Coinbase and Coinbase Pro?

Coinbase vs Coinbase Pro

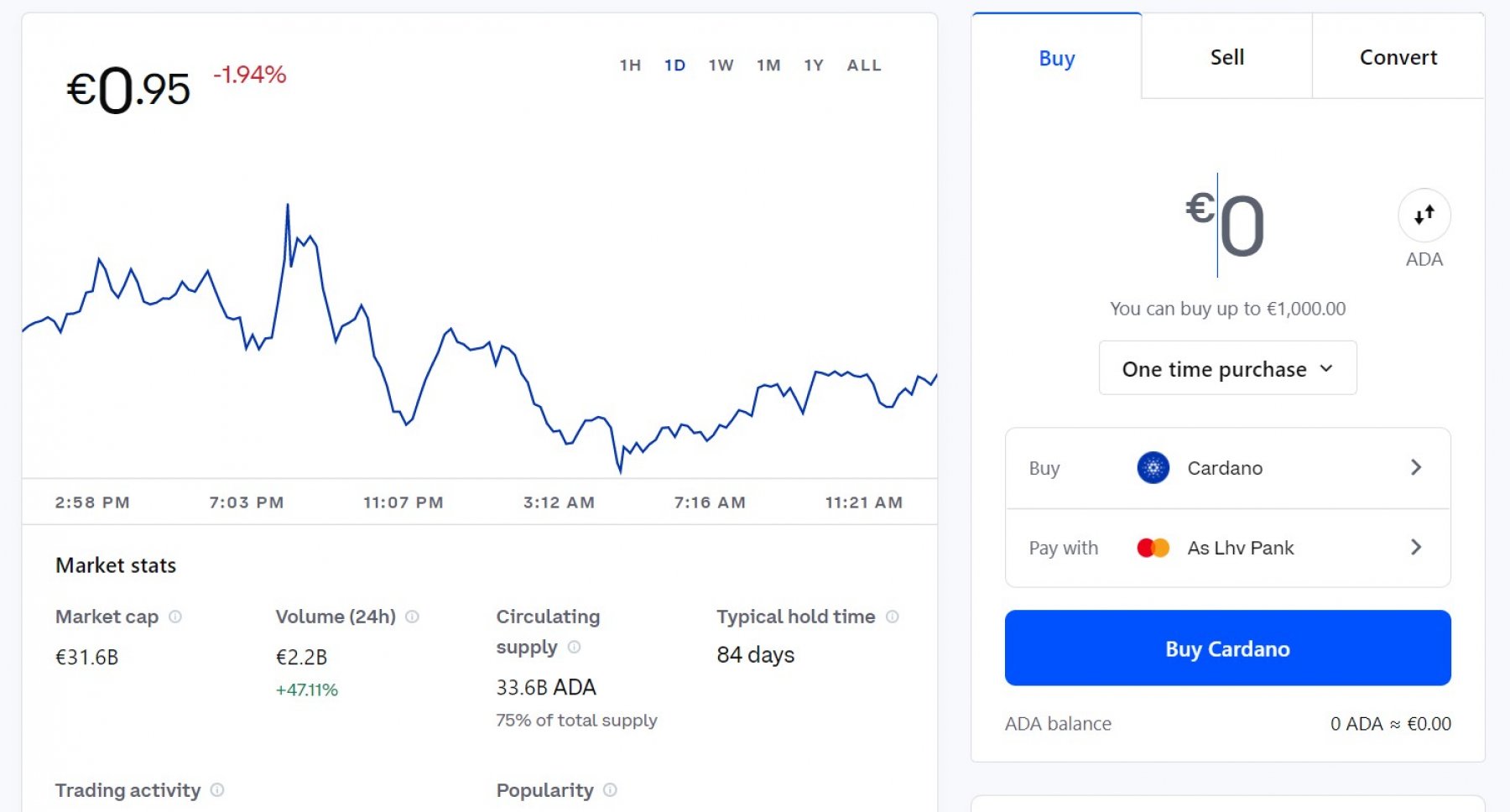

Coinbase is an easy platform, accessible through both desktop and mobile app, where you can buy, sell and trade cryptocurrencies.

Its clean interface offers newbies a very easy way to buy and sell cryptocurrencies with limited ways of making trades.

When it comes to fees, Coinbase fees are higher than Coinbase Pro fees.

What is Coinbase Pro?

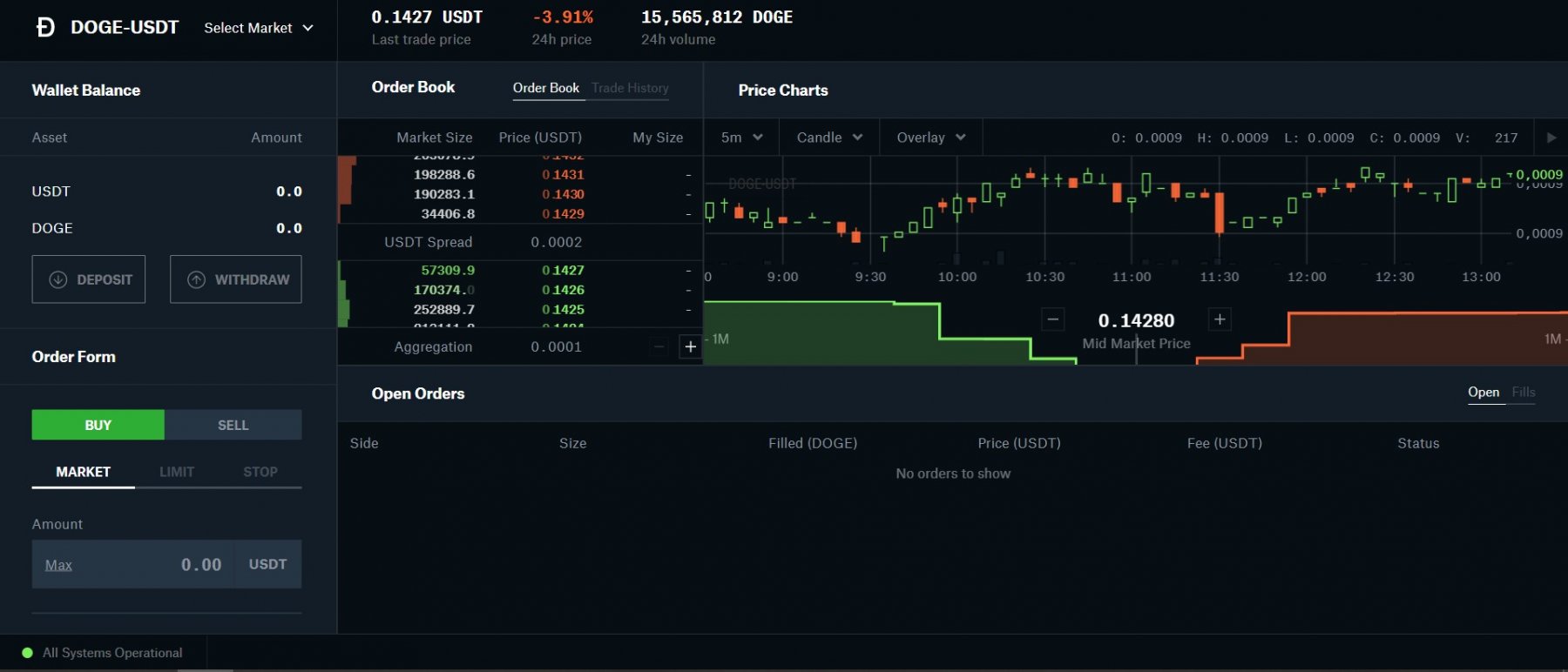

Coinbase Pro is more of a cryptocurrency exchange that offers you lots of digital charts and more cryptos to trade. Coinbase Pro is mainly meant for slightly more experienced traders.

And Coinbase Pro fees are generally lower.

But the main thing to know – if you sign up for one, you can use both of them.

Are Coinbase and Coinbase Pro linked? Yes! That’s because both Coinbase and Coinbase Pro are owned by Coinbase Global, Inc. and the two crypto trading options are both part of the same Coinbase platform.

Coinbase and Coinbase Pro comparison

Coinbase | Coinbase Pro | |

|---|---|---|

Simplicity | Very easy to get started | Advanced interface |

Cryptos | 100+ | 250+ |

Fiat deposits/withdrawals | No | Yes |

Fees | 0% to 0.50% per trade, plus roughly 2.49% for banking | 0% to 0.50% per trade |

Limits | Limits depend on used Coinbase payment method and your region | Unlimited |

Charts | No real charting options | Advanced charting options |

Transaction types | Buy, sell, send, receive, exchange | Buy, sell, receive, exchang, deposit, withdraw, trade, stop order, time in force order, limit order |

Who is is meant for | Beginners - more for personal use | Advanced users - more for business use |

So which should you choose, Coinbase or Coinbase Pro?

When you are just getting started, Coinbase is definitely easier for you. But later on we recommend switching over to Coinbase Pro.

How to switch from Coinbase to Coinbase Pro?

Coinbase has made things pretty confusing when it comes to switching from Coinbase to Coinbase Pro, because there's literally no button to do that, at least not in Coinbase desktop version.

And to be honest, that's extremely strange.

So to switch to Coinbase Pro, you need to open not coinbase.com, but pro.coinbase.com and log in with your credentials in there.

Normally, if you are already logged in to Coinbase and you also open Coinbase Pro and try to log in, you'll be logged in automatically to Coinbase Pro.

However, sometimes even that might not always be that easy, as sometimes Coinbase remembers which platform you used last time and forwards you immediately to Coinbase even if you log in from Coinbase Pro site.

Easy fix to that is to open an Incognito tab in your browser and login to pro.coinbase.com from there.

Transferring funds between Coinbase and Coinbase Pro

Although you get access to both – Coinbase and Coinbase Pro – when signing up, and the accounts are linked, each of them has their own separate wallets.

But the positive thing is that moving your cryptos between those wallets is free.

How to transfer funds from Coinbase wallet to Coinbase Pro wallet?

Transferring funds from Coinbase to Coinbase Pro is easy.

- Go to Coinbase Pro trading page

- Under Wallet Balance click Deposit

- Select currency

- Select Coinbase Account

- Enter amount to transfer from Coinbase to Coinbase Pro

- Select Deposit

How to transfer funds from Coinbase Pro wallet to Coinbase?

Transferring funds from your Coinbase Pro wallet to Coinbase is similar, with one main difference – instead of Deposit you need to use Withdraw option.

- Go to Coinbase Pro trading page

- Under Wallet Balance click Withdraw

- Select currency

- Select Coinbase Account

- Enter amount to withdraw from Coinbase Pro to Coinbase

- Select Withdraw

Where is Coinbase available?

Coinbase is available in more than 100 countries. And it is also among the not so many cryptocurrency exchanges which is also available to users in the US.

Coinbase crypto list

Coinbase has currently around 100+cryptocurrencies and Coinbase Pro more than 250 cryptocurrencies.

You can see the Coinbase Pro crypto list here.

If you want to find coinbase new listings, go to ournew cryptocurrencies page and see which of the new cryptos are available in Coinbase.

Deposits &withdrawals on Coinbase platform

What deposit options does Coinbase offer to its users?

Coinbase offers multiple payment methods including, but not limited to bank transfers, Paypal, and Credit card.

Those options are generally open for both –deposits and withdrawals and it is possible to do instant withdrawals to credit cards as well.

Coinbase payment methods for European customers

For its European customers, Coinbase offers the following payment options:

Payment method | Buy | Sell | Deposit | Withdraw | Speed |

|---|---|---|---|---|---|

SEPA Transfer | ✘ | ✘ | ✔ | ✔ | 1-3 business days |

Credit/debit card (instant crypto purcheses and withdrawals) | ✔ | ✘ | ✘ | ✔ | Instant |

Paypal | ✘ | ✘ | ✘ | ✔ | Instant |

Apple Pay | ✔ | ✘ | ✘ | ✘ | Instant |

Ideal/Sofort | ✘ | ✘ | ✔ | ✘ | 3-5 business days |

Coinbase payment methods for Americans

Coinbase payment methods for US customers are the following:

Payment method | Buy | Sell | Deposit | Withdraw | Speed |

|---|---|---|---|---|---|

Bank Account (ACH) | ✔ | ✔ | ✔ | ✔ | 3-5 business days |

Instant Cashouts to bank accounts | ✘ | ✘ | ✘ | ✔ | Instant |

Debit Card | ✔ | ✘ | ✘ | ✔ | Instant |

Wire Transfer | ✘ | ✘ | ✔ | ✔ | 1-3 business days |

PayPal | ✔ | ✘ | ✔ | ✘ | Instant |

Apple Pay | ✔ | ✘ | ✘ | ✘ | Instant |

Google Pay | ✔ | ✘ | ✘ | ✘ | Instant |

Does Coinbase exchange have a withdrawal limit?

Yes. The default daily withdrawal limit is $50 000.

Can Coinbase withdrawal limit be increased?

Yes. It can.

If you need to increase your Coinbase withrawal limit, go to your Profile page when logged in and click on Limits.

On limits page select “Increase Limits”.

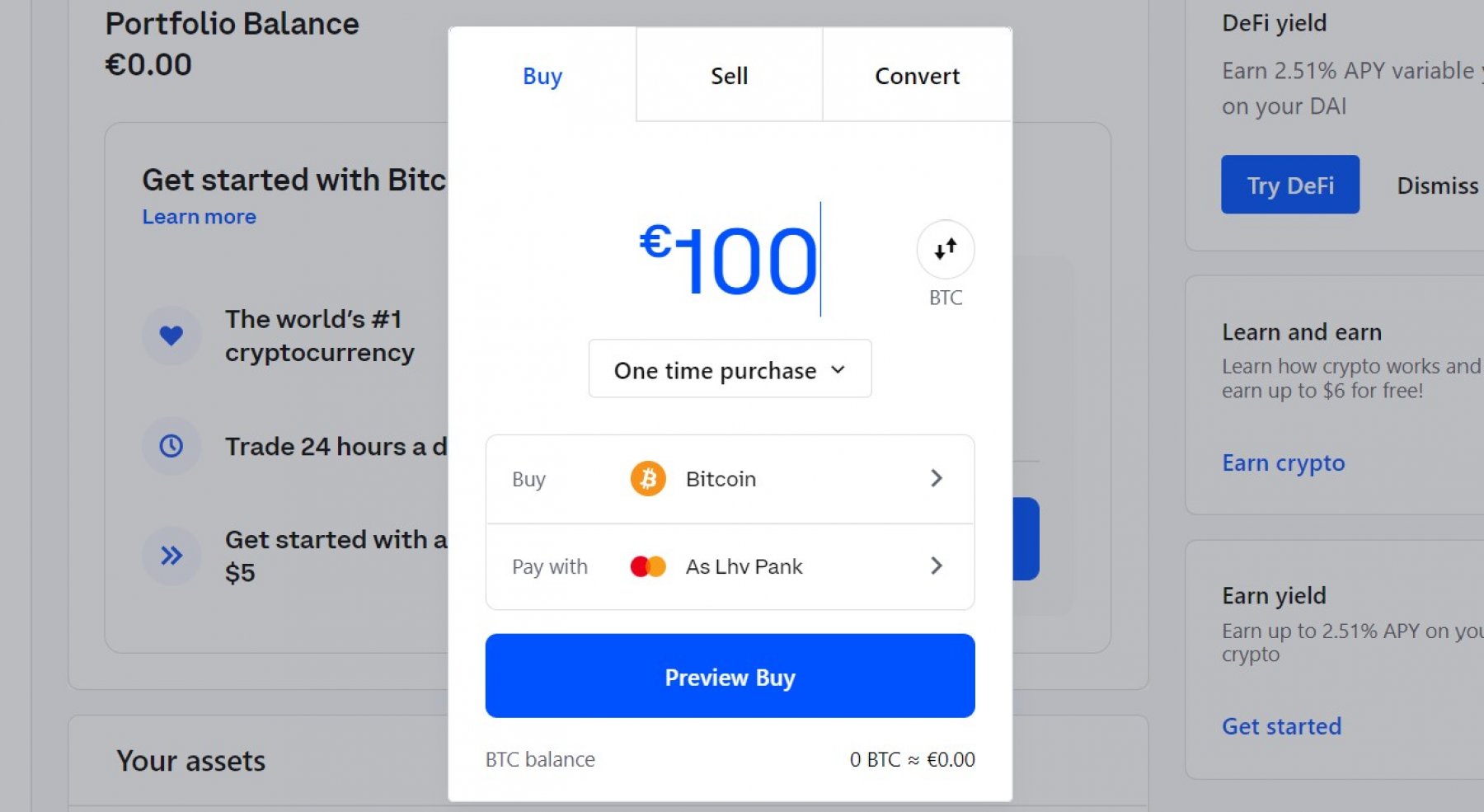

How to deposit on Coinbase?

It depends on your chosen payment method and platform.

In Coinbase just use the instant buy option.

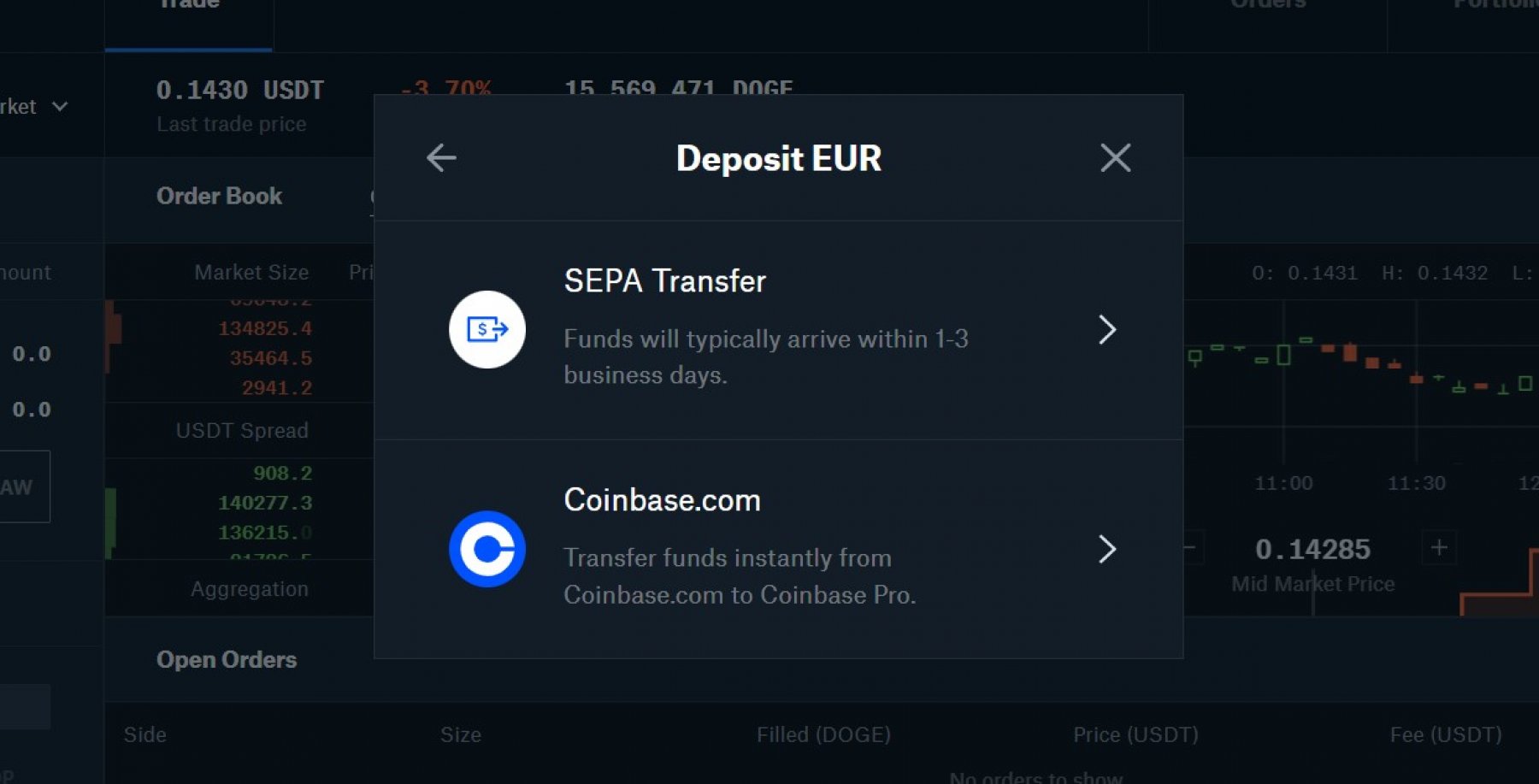

In Coinbase Pro do the following:

- Go to Trading View page

- Select Wallet Balance (left menu) and choose Deposit

- Choose Currency

- Select the correct payment type tab

Here's how it looks -

How to withdraw fiat from Coinbase?

Withdrawing fiat money from Coinbase platform is simple.

- First sell your crypto for fiat

- Secondly click Assets

- Click Cash balance

- Enter the amount to cash out

- Choose your cashout destination

- Click Cash out now

Please keep in mind that if you want to Cash out to your card or bank account, you need to have done a deposit with the same account as well.

Coinbase exchange deposit & withdrawal fees

How high are Coinbase deposit and withdrawal fees?

Well, these depend on your payment method and also platform you’re using.

We’ll be talking about the fees later on in the Coinbase fees paragraph.

Potential problems with Coinbase payments

There are various issues you might come across when trying to deposit or withdraw in Coinbase. Let’s take a look at a few of them.

1. I can’t withdraw EUR to my UK bank account

The easiest way to solve this issue is to first buy cryptocurrency with EUR and then sell the cryptocurrency for GBP.

And then you can make the withdrawal to your UK bank account. Not slick and beautiful, but that’s one way to do it.

2. My SEPA deposit never arrived

There are several possible reasons for that.

- You haven’t verified your identity yet (KYC)

- Your name on your bank account is different than the one in your Coinbase account

- The currency you were trying to send does not match your Coinbase account

- Your unique reference code was not used when making the deposit

- Your SEPA account information was not added to your Payment methods

These are just a few potential reason for the failed deposit.

Coinbase platform overview – where do I find what I need?

Coinbase is an easy cryptocurrency platform to get started. Buying and selling cryptocurrencies using either Coinbase Desktop version or Coinbase mobile app should be easy enough for everyone.

While the selection of cryptocurrencies Coinbase offers isn’t the highest, there are more than enough options for beginning traders.

Coinbase is mainly meant for cryptocurrency traders just making their first trades and traders who just want to convert one crypto to another and do it in an easy way.

Coinbase Pro on the other hand is the more advanced version of Coinbase and making trades there is slightly more complicated.

Coinbase - where to see profit

As with most other cryptocurrency exchanges, it’s not that simple to see the percentage growth for each and every cryptocurrency you have bought.

It shouldn’t be that difficult, but yet, it is.

Use Cryptolorium to track your Coinbase profit

For that we recommend creating a free Cryptolorium account and add all your trades here as well.

This is how you could see your profit:

Where do I see all the Coinbase fees I have paid?

- Log in to your Coinbase account

- Go to your Profile page

- Click Orders

- Choose Filled tab

Coinbase Wallet

Coinbase Wallet is a standalone application and you do not need to trade on Coinbase platform to use it.

Coinbase Wallet is available both for iOS and Android phones.

Coinbase digital wallet uses two-factor authentication and it makes it possible for you to manage cryptocurrencies from other third-party wallets as well.

When installing the wallet, you also need to choose your Coinbase recovery phrase which you need to keep safe. This recovery phase helps you to restore your wallet in case you lose access to your phone.

Coinbase card

If you want to, you can order yourself a Coinbase debit card. The card would be linked to your balance and you could use it to pay for anything anywhere in the world where VISA card is accepted.

Basically it’s a Visa card which uses your Coinbase balance for payments.

Using Coinbase card is as easy as using any debit or credit card.

You can pay online or at the groceries, withdraw money from ATMs, and do it all either contactless or using a PIN code.

And when paying, you can choose yourself which cryptocurrency you want to use for your fiat payments.

How to create Coinbase account?

Coinbase isn’t available in all countries, but they do accept customers from around 100 countries worldwide, so chances are good that your country is included there.

Before to start signing up, make sure you’re ready:

- You need to at least 18 years old

- You need to have your identity document ready. Note that in the US only Driver License or Identification Card are accepted, passport is not. Everywhere else you can use either ID card, Government-issued photo ID or passport.

- You obviously need to have internet connection

- You need to have a phone and a phone number.

- If you’re signing up through a smartphone, you also need to have the latest Coinbase app installed.

Now you’re ready to get started.

Follow these steps on how to set up a Coinbase account

Go to coinbase.com on your computer or open Coinbase app on your mobile.

- Coinbase sign up page can be found in the top-right corner, it's called "Get Started"

- Click on it

- Enter your full name, e-mail address, country/state, and choose password

- Accept the User Agreement and Privacy policy. Ideally should first read them both as well.

- Press Sign up/Create account button.

Verify your Coinbase Account

- Now Coinbase will send you an automatic email with a link inside it called „Verify Email address”.

- Press that, login in, and complete the email verification process

- Now that the email is verified, you’ll be prompted to add your phone number

- Enter your phone number

- Click the button under the form and submit it

- Coinbase will now send a code to your phone which you need to enter

- Once you have entered the code, press Submit.

Enter your personal information

Now you need to enter your personal information again – name, date of birth, full address, last digits of your SSN (if you’re an American).

Plus you need to answer a few questions.

Verify your identity

Before you can actually start trading, you’ll need to verify your identity.

During this process you’ll need to upload your ID document and possibly also proof of your address.

Your Coinbase account is active

After your identity documents have been verified by Coinbase, your account is fully activated, and you are ready to start trading.

Coinbase KYC

While you *might* be able to something in Coinbase without ID verification as well, you should definitely verify your account to be on the safe side.

Coinbase without verification could be compared to owning a car without an engine.

Now let’s examine what Coinbase identity verification process actually looks like.

How to verify your Coinbase account?

While some of those things you did already when signing up, these are all the things you need to verify during the Coinbase verification process:

- You need to verify your email address. Registering an account without email address is not possible.

- You need to verify you phone number. Registering an account in Coinbase without phone number is not possible.

- You need to verify your ID

- You need to Verify your address

Additionally you might also need to send them a photo with you holding your ID card/passport.

Note that you can do it all through Coinbase platform and you don’t need to send any documents over email or snail mail.

Why and when should you verify your Coinbase account?

You should verify your Coinbase account right after signing up, because without KYC Coinbase doesn’t really allow you to do much.

Coinbase app

Coinbase can be used on your computer, but there’s also Coinbase app which is available both for iOS and Android and can be downloaded for free either from Apple App Store or Google Play Store.

Coinbase mobile app is user/friendly and allows you to manage as well as trade cryptocurrencies on the go.

Coinbase Fees

So what should you know about Coinbase fees?

You can expect to come across at least three different types of fees:

- Deposit fees

- Withdrawal fees

- Trading fees

Coinbase deposit and withdrawal fees

Coinbase deposit and withdrawal fees depend on whether you are using Coinbase or Coinbase Pro.

Coinbase | Coinbase Pro | |

|---|---|---|

Credit & debit cards | 2.49% - 3.99% | - |

ACH Transfer | Free | Free |

Wire transfer | $10 deposit / $25 withdrawal | $10 deposit / $25 withdrawal |

Crypto conversion | 0.5-2% | - |

SEPA (EUR) | - | €0.15 EUR deposit, €0.15 EUR withdrawal |

Swift (GBP) | - | Free deposit, £1 GBP withdrawal |

As a rule of thumb, Coinbase Pro fees are lower, especially if you start trading for higher amounts. And Coinbase Pro allows you to deposit and withdraw fiat as well.

Coinbase trading fees

The fees vary, but Coinbase fees in general are the following:

- Crypto conversion – 0.5-2%

- Trading on Coinbase - $0.99 to $2.99 based on the amount

- Trading on Coinbase Pro - 0.04% to 0.50% taker fee, 0% to 0.50% maker fee

Coinbase fees can be confusing as the fees depend on multiple factors:

- Payment type

- Your monthly trading amount

- Spread fee

Plus, as we have already mentioned, it also depends on which platform you’re trading on – Coinbase or Coinbase Pro.

In Coinbase platform the trading fees are the following:

Trade amount | Fee |

|---|---|

< $10 | $0.99 |

$10 - $25 | $1.49 |

$25 - $50 | $1.99 |

$50 - $100 | $2.99 |

Coinbase Pro trading fees, on the other hand, look something like this:

Trading volume | Taker fee | Maker fee |

|---|---|---|

Up to $10K | 0.50% | 0.50% |

$10K - $50K | 0.35% | 0.35% |

$50K - $100K | 0.25% | 0.15% |

$100K - $1M | 0.20% | 0.10% |

$1M - $20M | 0.18% | 0.08% |

$10M - $20M | 0.18% | 0.08% |

$20M - $100M | 0.15% | 0.05% |

$100M - $300M | 0.1% | 0.02% |

$300M - $500M | 0.08% | 0.00% |

$500M - $750M | 0.06% | 0.00% |

$750M - $1B | 0.05% | 0.00% |

$1B+ | 0.04% | 0.00% |

Coinbase Earn - earn crypto through Coinbase Learn

As with many other cryptocurrency exchanges, Coinbase offers you the chance to earn with your cryptos.

Although, compared to many other exchanges, the EARN options are rather limited.

In Coinbase you are offered mainly one earning option – earn while you learn.

You need to complete tasks on their site – such as learn about cryptocurrency trading or learn about a specific crypto – and you get rewarded for that in free crypto.

So in Coinbase free crypto is offered for educating yourself.

Can you lose money with Coinbase Earn?

Considering the way Coinbase Earn works, the answer is no.

You can not lose money with Coinbase Earn and Coinbase rewards are yours to keep.

Coinbase customer support

Coinbase customer service can be contacted in three different ways:

- Chatbot

- Automated phone system. Coinbase customer service number in US is +1 (888) 908-7930. In UK the number is +44 808 168 4635 and in Ireland it's +1 800 200 355. These are all toll-free numbers. Local Coinbase customer service numbers are +1 (844) 613-1499 for US/International, +44 151 308 1768 for UK and +353 1 529 5132 for Ireland.

Coinbase has also an extensive Help page and a strong library of all kinds of educational content that offers answers about most questions you might have.

And that’s a good thing.

That’s because Coinbase users in general are not happy with Coinbase support.

They say answers from Coinbase customer service take time and rate their customer support pretty poorly.

Pros and cons of using Coinbase

Pros | Cons |

|---|---|

Beginner friendly | Complex fee structure |

Good crypto app | High fees compared many other exchanges |

Low minimum to get started ($2) | Crypto selection not the biggest |

Learn to Earn feature | Complicated to understand the two platform thing at first |

Two platforms to choose from | Coinbase support does not have very high rating |

Credit card payment option | |

Fiat deposit option | |

Advanced trading platform | |

Extensive help center | |

US traders accepted |

Other questions you might have about Coinbase

Here we will be listing other questions related to Coinbase exchange as we think of them.

How to get started with Coinbase Pro?

Getting started with Coinbase PRO is easy.

- Register Coinbase account

- Go to pro.coinbase.com url

- Log in

- Link your bank account

- Start buying & selling

Conclusion

Coinbase is one of the top cryptocurrency exchanges in the world that is available to people from around 100 countries. And they also accept traders from the United States.

Coinbase offers two separate platforms – Coinbase for beginners and Coinbase Pro for advanced traders.

Coinbase coin list is pretty decent, although they do not offer access to many less known altcoins.

Coinbase earn and learn section does offer you the chance to get free crypto, but unfortunately their offerings are rather limited.

But just the ability to earn free crypto on Coinbase is good, even if the free crypto offerings are for $3 at a time. Obviously this type of offers are not for everyone, but there are many beginner traders who might appreciate it.

Coinbase fees are complex and generally rather high compared to many other top exchanges.

But in general, based on our own experience and research we made during writing this Coinbase review, we can say that Coinbase is a perfect cryptocurrency exchange for beginners to get started and it’s also one of the safest exchanges around.

We hope that this Coinbase guide helped you to understand everything related to Coinbase better.